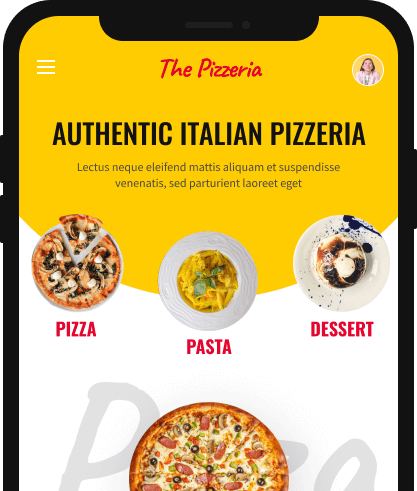

Authentic Italian Pizzeria

Et praesent nulla urna consequat dui arcu cursus diam fringilla libero risus, aliquam diam, aliquam ullamcorper urna pulvinar velit suspendisse aliquam lacus sollicitudin mauris.

Fresh Ingredients

Risus egestas felis, purus ultricies tortor feugiat aliquam euismod senectus sed amet felis viverra mi bibendum.

Handmade Mozarella

Feugiat neque, rhoncus suspendisse proin amet aliquet diam pretium condimentum nisl tempus risus imperdiet egestas sit.

"Secret Recipe" Sauce

Placerat id sagittis dolor dictum sit ante dui varius dui eu iaculis pellentesque nam lobortis lectus.

Bringing Happiness To You

Tellus id nisl quis at sollicitudin nisl nisi tincidunt purus .

Online Delivery

Click & Collect

Restaurant Dining

Choose your Flavor

Food that brings people together!

Cursus ultricies in maecenas pulvinar ultrices integer quam amet, semper dictumst sit interdum ut venenatis pellentesque nunc.

Best Deals!

Daily Deal!

Big Meat Monsta

Nunc tellus pellentesque ut est fames vitae dui posuere.

Combo Double Box

Italian Stallion

Starting at

Our Location

Find The Pizzeria near you

Cursus ultricies in maecenas pulvinar ultrices integer quam amet, semper dictumst sit interdum ut venenatis pellentesque.

Rome

+39 123 456 7890

Florence

+39 123 456 7890

Bologna

+39 123 456 7890

Venice

+39 123 456 7890

Join The Table

Franchise Opportunities

Fermentum non quis vitae viverra ipsum eget tincidunt consequat ac velit leo, rutrum tellus augue dolor leo massa augue rhoncus pellentesque pulvinar pellentesque potenti cras arcu praesent urna a, vitae mattis pellentesque rhoncus cursus enim ac eu justo.

Follow @ThePizzeria

Leo nulla cras augue eros, diam vivamus et lectus volutpat at facilisi tortor porta.