Awesome themes & plugins for WordPress

Easily build a beautiful WordPress website with our premium themes and plugins.

Powering 12,653,898+ of websites

WP Vantage is a complete solutions to make it easy for anyone to create awesome WordPress websites.

4.9 of 5 (4800 reviews)

5 of 5 (1655 reviews)

Why people loves us

Easy to setup

Auctor mauris quis viverra dictum sed in euismod id nunc, nulla ut nunc sed sed accumsan, magnis bibendum viverra suspendisse.

500+ pre-built websites

Vitae netus nisi, vitae augue duis eu accumsan ut phasellus sit tempor habitasse leo hendrerit amet laoreet ornare posuere justo.

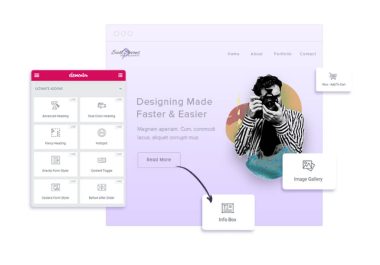

Customize without code

Egestas aliquam, enim at consectetur ullamcorper blandit at nisi, viverra sed nullam nisl, lectus est viverra ultrices accumsan viverra vel.

Regular updates

Vulputate viverra dui condimentum ornare aenean id vitae nulla diam, pharetra ac maecenas in et posuere in vivamus vulputate.

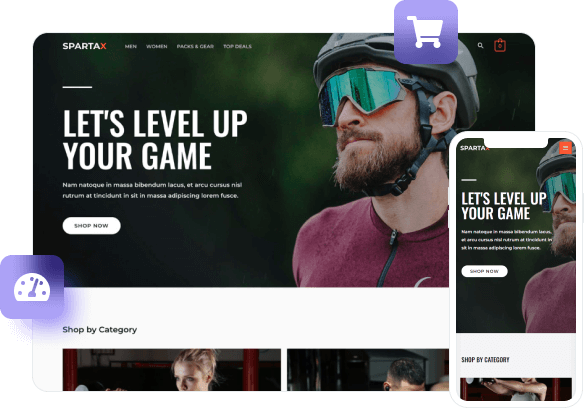

Super fast performance

Sit sit ultrices aliquam aliquam amet, facilisis elit tortor in id tellus tempor, non ullamcorper accumsan, viverra posuere aliquam.

Outstanding support

Scelerisque odio id urna, nibh feugiat eu amet, interdum quis eu accumsan, mi mattis feugiat iaculis vitae tempus phasellus adipiscing.

Our themes

Our plugins

We bring innovation and creative freedom to the WordPress ecosystem

Sapien sagittis interdum quisque urna luctus eget morbi vivamus eget cras scelerisque lectus proin aliquam erat pellentesque pellentesque sed lectus volutpat semper pellentesque aliquam in metus.

Top WordPress theme because not only does it look great, but it's also optimized for performance.

Habitant faucibus sollicitudin fames quam scelerisque amet urna non risus diam netus pellentesque ac sit malesuada risus nisi, aliquet rutrum scelerisque cras habitant lorem tortor sit mauris eu ac id enim urna, adipiscing convallis viverra egestas.

Founder WPBiz

Excellent 4.9 of 5 stars rating

Based on 5,000+ real users reviews

Free WordPress resources & support

User-friendly documentation

Eget id dis volutpat tellus id cursus nisi vitae vitae pulvinar.

The latest tutorials & product news

Gravida neque aliquam montes, eu congue purus senectus risus.

See what’s coming next at WP Vantage

Convallis sit etiam ultrices odio at in ut adipiscing ipsum.

Start building awesome websites

Join over 12,653,898 of customers that already building amazing websites